Are there any negatives of green mortgages?

In short, it depends on what type of ‘green’ mortgage. The ‘greenest of green’ lenders is the Ecology Building Society, and their negatives could fall into two camps: property, and price.

Ecology do not lend on all types of property (they aren’t interested if your home is not eco-friendly), so are not suitable for many homes.

However, if you are looking to do an innovative self-build, convert a property to radically improve its energy efficiency, downsize to live in a houseboat, buy some woodland, or other eco-motivated decisions, they may well be your best option.

Ecology also tend to be relatively expensive compared to the high street. However, when compared to other niche lenders and smaller building societies, their rates are reasonably similar. You aren’t going to get any chart-topping rates, but when comparing like-for-like, the price is less of a negative than it first appears.

Beyond this specialist lender, neither price nor availability seems to be an issue between the greener or less green mortgage lenders.

In many cases, when we source the lowest cost mortgage deals available for a customer, then often those with a ‘green’ label, or those by one of the highly rated ethical mortgage lenders do come up cheapest overall.

For example, the high street lenders that offer cashback for properties with an EPC of A or B are usually very price competitive.

More encouragingly, one of either Nationwide, Coventry, Skipton, Accord, Leeds or Platform (all of whom score very highly with Ethical Consumer) is almost always in the top five cheapest available.

There are a couple of specific circumstances where you may be at a disadvantage for taking a green mortgage. The most common ones we come across are, if you are paid in Euros, or are not a UK or EU citizen, then you are usually left with a choice between a high street bank or a small building society.

Typically, the smaller building society may be classed as a green lender, but due to their size and flexibility, many of them have a slower application process and less competitive rates.

Finally, it is worth considering home improvement type mortgages and how practical it is to take on additional lending at a time when you might already be fully stretched financially. As a response, we are seeing more mortgages offered where the incentives are available at any point during the mortgage. This is great as it means lenders are helping borrowers decarbonise their home at the right time – rather than only being available at the point of taking out a mortgage.

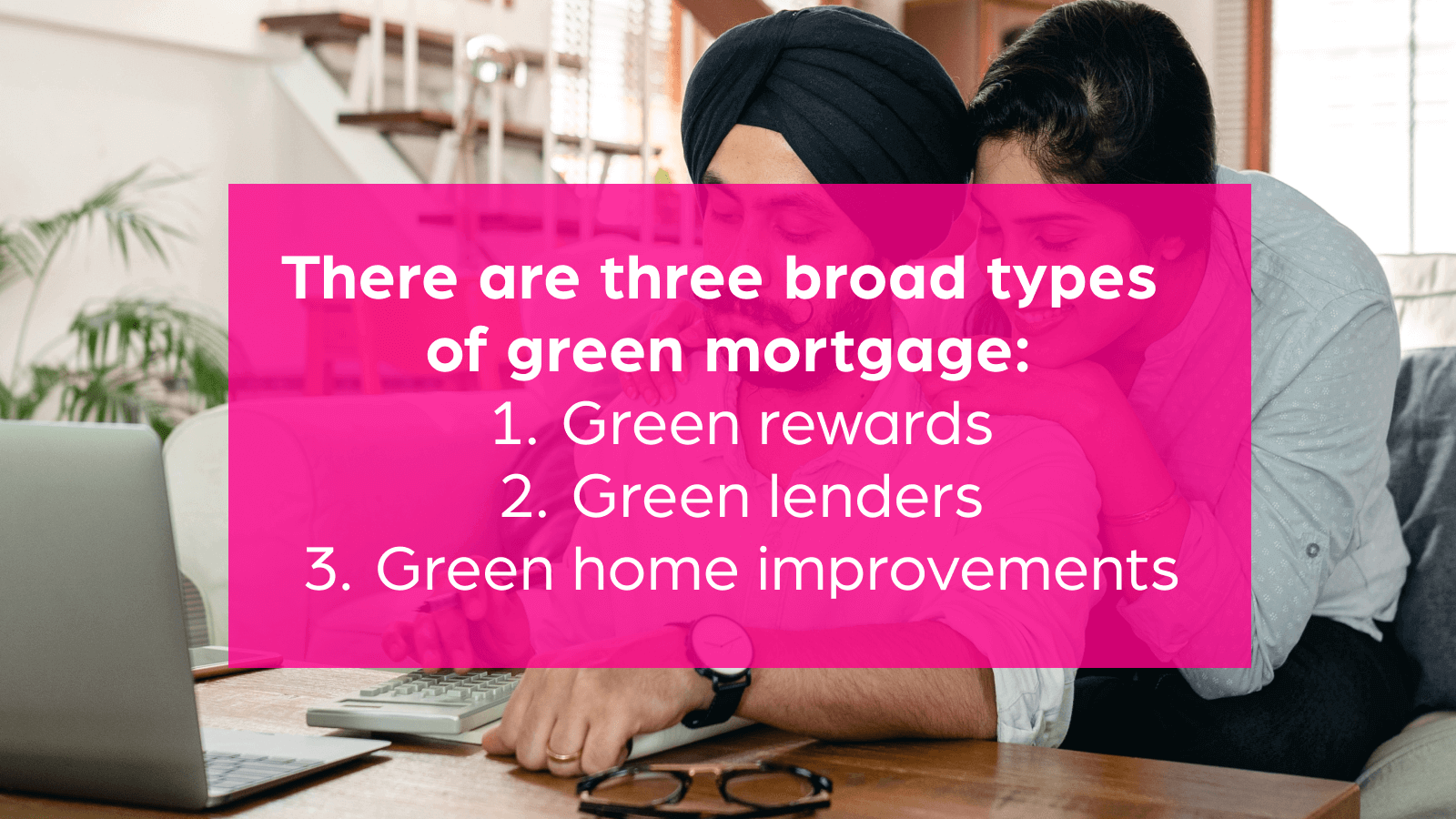

Who is offering green mortgages?

Mortgages that could be classed as ‘green’ are offered by almost all of the standard mortgage providers in the UK housing market and many of the smaller ones too.

Below we look at the ‘top 10’ lenders by market share broken down across the type of green mortgage they offer.

Green reward mortgages – are offered by Natwest, HSBC, Santander, Virgin & Lloyds banking group (inc. Halifax, Scottish Widows & BM Solutions). This group accounts for nearly 70% of mortgages in the UK.

Green lenders – Coventry and Yorkshire (inc. Accord) Building Societies are rated a ‘best buy’ by Ethical consumers, recognising the many steps they take to minimise their environmental impact (and take other positive ethical stances). Nationwide, as a building society, also score reasonably well. TSB are aiming to be net zero by 2030, but currently are rated mid-table by Ethical Consumer.

Green home improvements – Nationwide & Santander offer green further advances at very competitive rates, making it easier for existing customers to finance green home improvements.

It is interesting to reflect on the ethical ratings of those lenders offering Green Reward mortgages. Bar Virgin, they all score very lowly, reflecting their investment in industries and practices that have contributed to the climate emergency.

However, a search for ‘Green Mortgages’ will bring them up as options – it is therefore easy to see why these options have been labelled as greenwashing.